The Hollis Law Firm handles cases for people who have been injured by harmful prescription drugs and medical devices.

It takes more than just an understanding of the law to handle prescription drug and medical device cases.

In order to be a leader in the area of pharmaceutical law, a law firm must also understand the science. The Hollis Law Firm takes pride in knowing not only the legal aspects of each case, but the science behind it. The Hollis Law Firm stays up-to-date on the latest scientific literature relating to each case type and other potentially harmful drugs and devices currently on the market.

Our drug and device attorneys represent clients nationwide.

The Hollis Law Firm is at times able to detect patterns of certain products causing specific injuries before any scientific studies are published. This is because scientific studies can take years to properly design, conduct, peer-review, and publish.

We rely on you! Victims calling in from around the nation to report how they were injured by a prescription drug or medical device is how we learn what to investigate next. The pharmaceutical and medical device companies are not testing their drugs and devices before selling them to millions of people nationwide. The victims of these dangerous drugs and devices are typically the first to become aware of the side effects. Make your injury known, the pharmaceutical and medical device companies aren’t going to do it for you.

Current Cases

-

Dangerous Drugs

-

Defective Devices

Your Results Matter to Us

$0M+

Collected for our clients in settlements & judgements

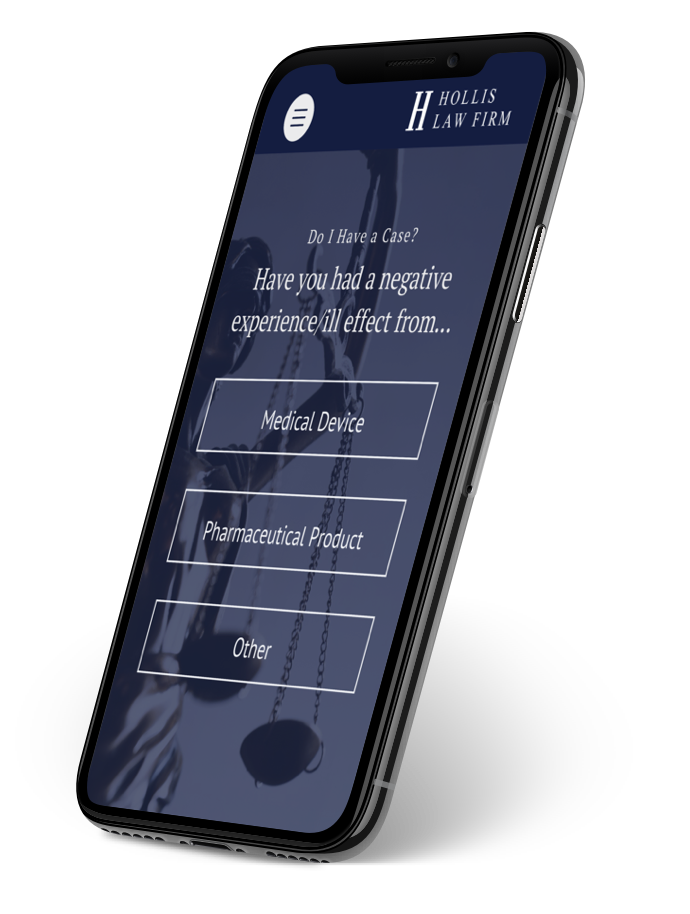

Do I Have a Case?

Give us a few details about your concerns and our case tool will help you get the answers you need.

Recent News